The Savannah residential market is the third-largest metropolitan market in Georgia with a total population of 393,353 as of July 2019. The area’s population has been growing at the third-fastest rate in the state and well above the national growth rate over the last 10 years. In particular, over the period 2010-2019, Savannah’s population increased at a rate of 13.2%, which is more than twice the respective national growth rate of 5.4% and only slightly below the highest population growth rate in the state that was registered in the Atlanta metropolitan area over the same period.

Savannah city is the oldest city in Georgia attracting each year millions of visitors to its historical sights. The area’s historical character provides a perfect blend with the modern and rich lifestyle, as well as the variety and multiplicity of amenities and services offered by a large urban area. Savannah is home to Savannah Wildcats, a charter member of the Continental Basketball League, the Savannah Bananas, a minor league baseball team, and the Savannah State Tigers football team that represents Savannah State University in college football.

Investing in the Savannah residential real estate market makes a lot of sense for several reasons:

- It is backed by a strong, diverse, and fast-growing economy that reduces long-term investment risk and supports fast population growth

- It is fuelled by above-average population and income growth, which contributes to a robust and rising demand for housing

- Offers adequate liquidity and easy investment entry and exit

- Offers above-average long-term capital returns

A strong, diverse, and fast-growing economy reduces long-term investment risk and supports fast population growth

Savannah’s residential market is backed by a solid, diverse, and fast-growing economy, producing new jobs at an above-average rate, which supports above-average population growth.

The Savannah metropolitan economy is the 3rd largest economy in the state of Georgia, with total employment of 185,200 as of December 2020. Savannah’s major manufacturing employers include Gulf Stream Aerospace Corporation, SNF, Georgia-Pacific, and International Paper. The major non-manufacturing employers include the Memorial University Medical Center, St. Joseph’s/Candler Hospital, Walmart, Kroger, SSA Cooper, and Marine Terminals Corp.

Savannah’s economy is quite diverse with Trade, Transportation, and Utilities having the highest contribution of 24.7% to the area’s total employment and with Education and Health Services, Professional and Business Services, Government, and Leisure and Hospitality, having each a contribution that ranges from 12.6% to 14.8% (see Figure 1). This diversity makes Savannah’s economy less vulnerable to industry-specific economic shocks, which in turn reduces the long-term risk of investments in the area’s residential market.

Figure 1 Savannah metropolitan area non-farm employment composition by economic sector in December 2020

The fast growth rate of the Savannah economy is evidenced in its average job growth rate over the last ten years. In particular, the annual job growth rate in the Savannah metropolitan area over the period 2010-2019 averaged 2.2%, well above the national average of 1.6% for the same period. This strong job growth rate fuels strong population growth and new household formation, which is the key to the rising demand for housing in the area’s residential market.

Above-average population and income growth create a robust and rising demand for housing in the Savannah residential market

The population of the Savannah metropolitan area increased from 347,597 people in 2010 to 393,353 in 2019. This represents a growth rate of 13.2%, which is more than twice faster than the rate at which the nation’s population increased over the same period.

In terms of the area’s key demographics, the median age of the area’s population was 36.2 years in 2019, with 47.4% being in the age group of 20-54 (see Figure 2). This age group comprises the households that are most active in the housing market by renting a house, buying their first home, or upgrading to a better house. In terms of racial composition, 60.7% of the Savannah metropolitan area population were White in 2019, 34.2% Black or African Americans, and 3.4% Asian.

Figure 2 Savannah metropolitan area population by age group in 2019

Robust and fast-rising demand for both owner-occupied and rental housing in the Savannah residential market is fuelled not only by the area’s strong population growth but also by the fast-rising income and wages.

According to Census Bureau data, the per capita income in the Savannah MSA in 2019 was $31,541 and the median household income $60,371. Furthermore, 59% of the area’s households had an income in excess of $50,000. Over the period, 2010-2019, total personal income and wages/salaries in the Savannah MSA have been rising at the strong average annual rates of 4.2% and 4.6%, respectively, practically matching or exceeding the respective national rates of 4.4% and 4.1%.

Rental housing demand in the Savannah residential market has been rising faster than supply consistently from 2010 until 2018, according to a report published in June 2019 by the Department of Housing and Urban Development. In particular, according to the report the rental housing vacancy rate in the Savannah metropolitan area fell from about 11% in 2010 down to about 4.5% by the end of 2018.

Significant transaction activity provides sufficient liquidity and easy investment entry and exit

The Savannah residential market is the third-largest market in the state of Georgia in terms of transaction activity. According to the Georgia Association of Realtors (GAR), in 2019 a total of 4,669 housing units were sold in the Savannah residential market, representing a 15% increase compared to 2018. According to the Savannah Association of Realtors, the Savannah area real estate market finished 2020 in a strong fashion, with increases in the average sales price and total sales volume for the year exceeding $2 billion.

According to the National Association of Realtors, the average number of days in the market of listed homes until the sale was 67 days in January 2021 and, on average, houses were sold at 97.4% of the original price listed.

The Savannah residential market offers to investors strong and above-average capital returns

The strength and robustness of demand for housing in the Savannah residential market are underscored by the strong and consistent increases in house prices in the last nine years (2012-2020).

According to the Freddie Mac House Price Index, house prices in the Savannah metropolitan area have been rising consistently since 2012, mostly at rates above 5%, with the largest increase of 10.7% occurring in 2020 (see Figure 3). These strong price increases have provided high capital returns to Savannah residential market investors. The Freddie Mac house price index measures changes in prices for the same house quality in order to capture changes in prices that are solely attributable to market forces. As such, it is a better measure of changes in market prices through time than median prices.

Figure 3 House price changes in the Savannah metropolitan area: 2012-2020

According to the National Association of Realtors (NAR), the median sales price of existing single-family homes in the Savannah MSA in December 2020 was $368,000, representing a 31.4% increase compared to the median sales price of $280,000 in December 2019.

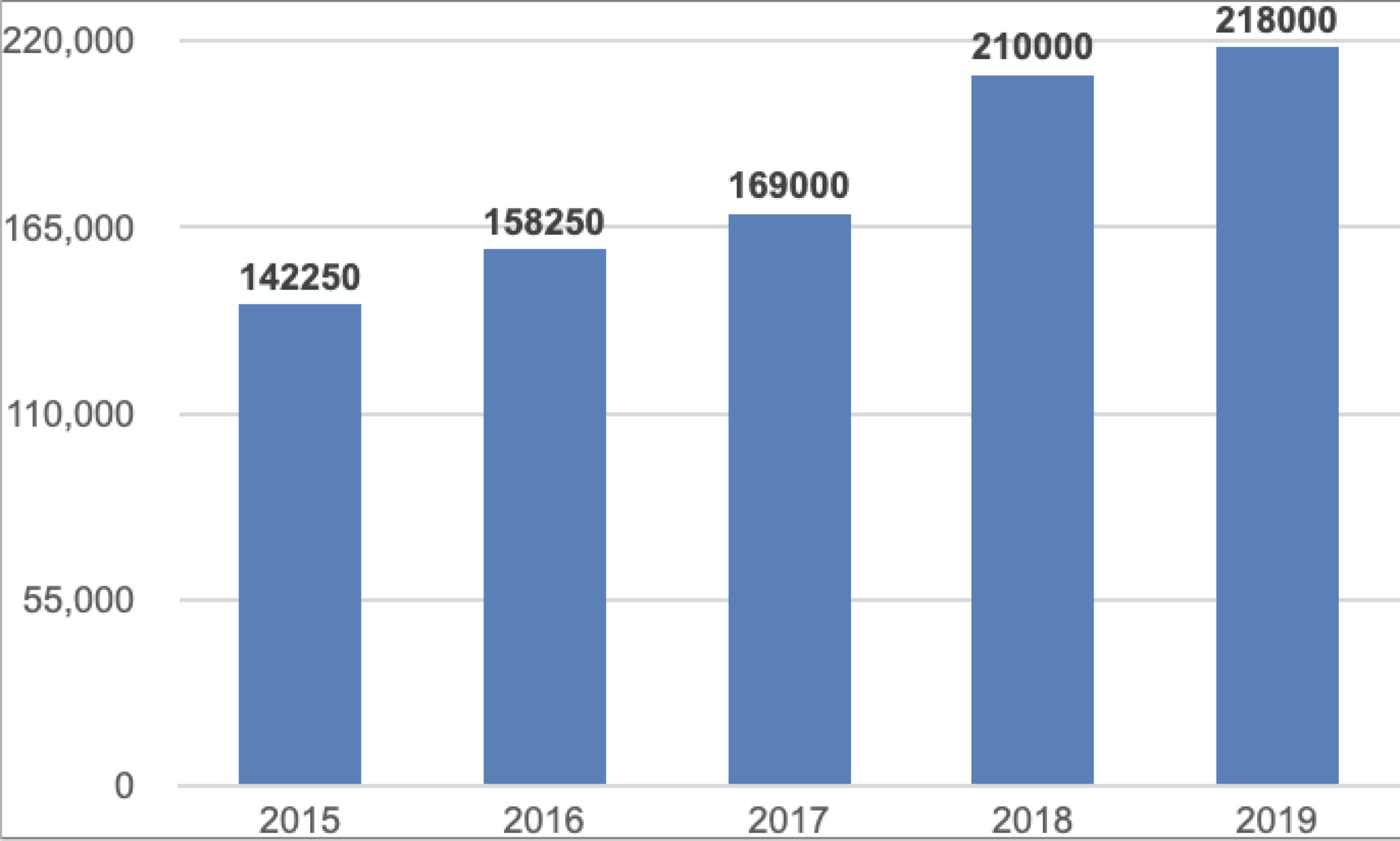

Median house prices in the Savannah metropolitan area from 2015 to 2019 reflect the same rising trend portrayed by the Freddie Mac house price index. As indicated in Figure 4, the median house price in the Savannah area increased from $142,250 in 2015 to $218,000 in 2019 representing a 53.3% increase, which is considerably higher than the 32.4% increase in the median house price that was registered in the Atlanta metropolitan area over the same period.

Figure 4 Median sales prices in the Savannah residential market 2015-2019

Conclusion

The Savannah area is the third-largest housing market in Georgia and has been growing consistently and at strong rates in terms of population, employment, income, and house prices for most of the decade 2010-2020. All these, in combination with the diversity of the local economy,, reduce the long-term risk of investments in the Savannah residential market and provide investors with easy investment entry and exit, and strong capital gains. That is why it makes a lot of sense to invest in the Savannah residential market.

*The Savannah area is the third-largest housing market in Georgia and has been growing consistently and at strong rates in terms of population, employment, income, and house prices for most of the decade 2010-2020. All these, in combination with the diversity of the local economy,, reduce the long-term risk of investments in the Savannah residential market and provide investors with easy investment entry and exit, and strong capital gains. That is why it makes a lot of sense to invest in the Savannah residential market.